Gold may halt rally after 8 Days of Buying as Doji Appears on Daily Chart, Bond Yields crossed 200DSMA on Daily.

Gold Prices took some breather yesterday after touching a All Time High Levels of $2740.60. We have seen some Profit Booking from higher levels & Gold prices corrected and made a low near 2714. However, in Asian Session Buyers again took charge & at the time of writing this report Gold Prices are trading at $2733-2734 Levels.The uncertainty surrounding the US Presidential election on November 5, along with the risk of a broader Middle East conflict and the expected interest rate cuts by major central banks, continue to offer some support to the safe-haven precious metal. However, US10 Year Bond yields have crossed 200DSMA on Daily Chart and currently trading at 4.21%.

Gold Structure: Doji on Daily after 4 days of Uptrend, Possibility of Double top on 4hr.

Intraday Strategy/ Intraday Trend: Buy on Support/ Sell on Resistance, Mild Weak below 2714, Strong above 2740/ Neutral

Weekly Trend: Hyper Bullish

Major Resistance: 2740,Undefined, Undefined

Major Support: 2728,2721,2714

Recent News

DAX MAKING BEARIGH FLAG, TRENG BULLISH ?

October 23, 2024

Market Insights

DAX making bullish flag, bulls come back...

October 24, 2024

Market Insights

Gold Outlook.

October 11, 2024

Market Insights

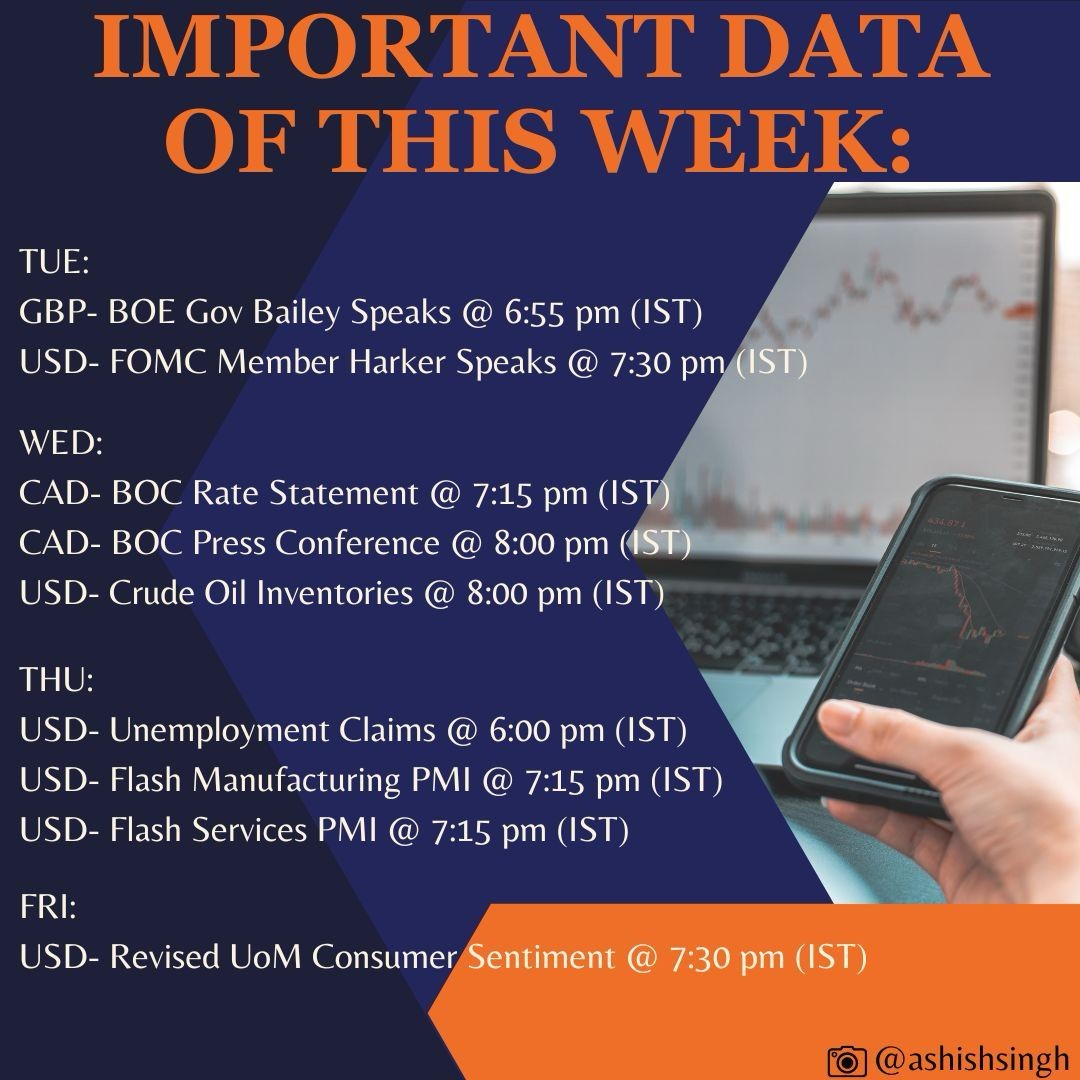

IMPORTANT DATA AND EVENT FOR THE WEEK

October 22, 2024

Market Insights

Crude Oil Analysis

October 11, 2024

Market Insights

Gold Prices Rise Amid Geopolitical Tensi...

November 04, 2024

Market Insights